By SUSANNE CRAIG, JO BECKER and JESSE DRUCKERJAN. 7, 2017

On the night of Nov. 16, a group of executives gathered in a private dining room of the restaurant La Chine at the Waldorf Astoria hotel in Midtown Manhattan. The table was laden with Chinese delicacies and $2,100 bottles of Château Lafite Rothschild. At one end sat Wu Xiaohui, the chairman of the Waldorf’s owner, Anbang Insurance Group, a Chinese financial behemoth with estimated assets of $285 billion and an ownership structure shrouded in mystery. Close by sat Jared Kushner, a major New York real estate investor whose father-in-law, Donald J. Trump, had just been elected president of the United States.

It was a mutually auspicious moment.

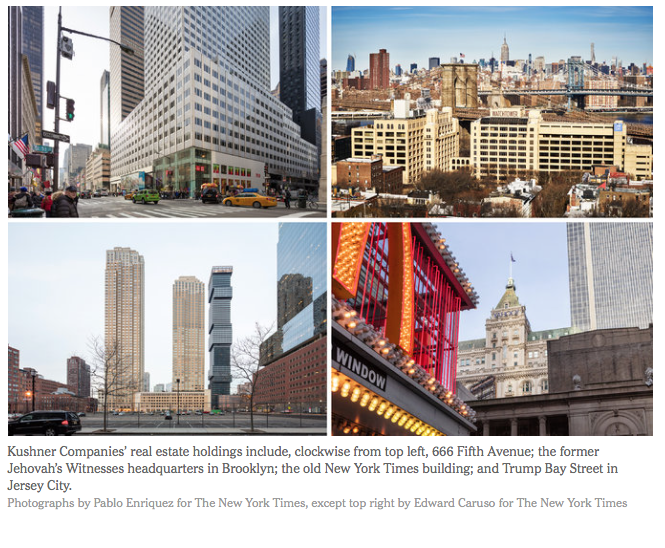

Mr. Wu and Mr. Kushner — who is married to Mr. Trump’s daughter Ivanka and is one of his closest advisers — were nearing agreement on a joint venture in Manhattan: the redevelopment of 666 Fifth Avenue, the fading crown jewel of the Kushner family real-estate empire. Anbang, which has close ties to the Chinese state, has seen its aggressive efforts to buy up hotels in the United States slowed amid concerns raised by Obama administration officials who review foreign investments for national security risk.

Now, according to two people with knowledge of the get-together, Mr. Wu toasted Mr. Trump and declared his desire to meet the president-elect, whose ascension, he was sure, would be good for global business.

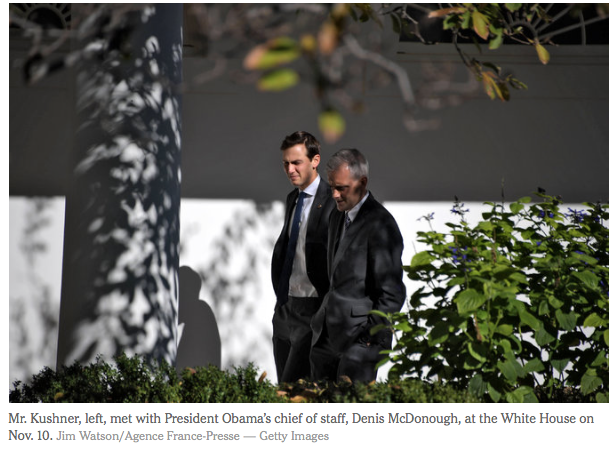

Since the election, intense scrutiny has been trained on Mr. Trump’s company and the potential conflicts of interest he will face. But with Mr. Kushner laying the groundwork for his own White House role, the meeting at the Waldorf shines a light on his family’s multibillion-dollar business, Kushner Companies, and on the ethical thicket he would have to navigate while advising his father-in-law on policy that could affect his bottom line.

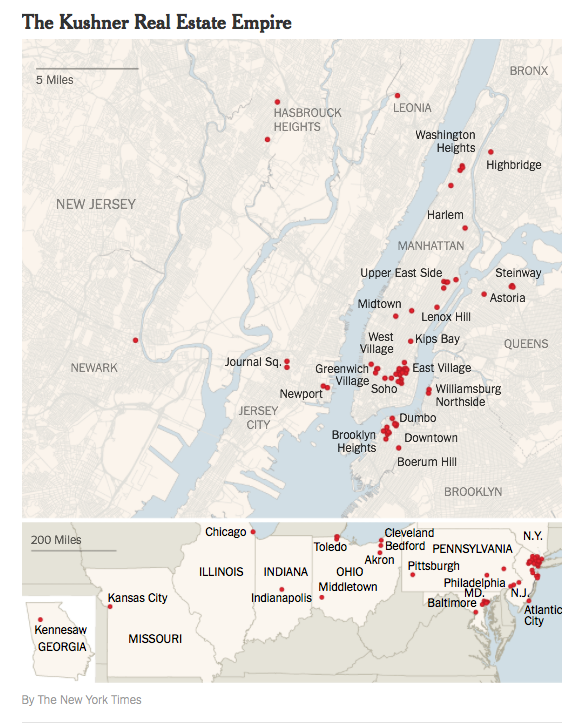

Unlike the Trump Organization, which has shifted its focus from acquisition to branding of the Trump name, the Kushner family business, led by Mr. Kushner, is a major real estate investor across the New York area and beyond. The company has participated in roughly $7 billion in acquisitions in the last decade, many of them backed by opaque foreign money, as well as financial institutions Mr. Kushner’s father-in-law will soon have a hand in regulating.

The Anbang talks, which have not previously been reported, began roughly six months ago — “Well before the president-elect’s victory,” Mr. Kushner’s spokeswoman, Risa Heller, noted. That was, however, just as Mr. Trump clinched the Republican nomination. While the talks are far along, representatives for Mr. Kushner said some points remained unresolved. Ms. Heller declined to outline the financial terms under discussion.

Mr. Kushner, who declined to be interviewed for this article, has hired a leading Washington law firm, WilmerHale, to advise him on how to comply with federal ethics laws should he join the White House staff as an adviser to the president. The firm has concluded that one potential sticking point, a federal anti-nepotism law, is not applicable, though not all ethics experts agree. While the law prohibits federal officials from hiring relatives for agencies they lead, Mr. Kushner’s lawyers argue, among other things, that the White House is not an agency and is therefore exempt.

As for conflicts of interest, Mr. Kushner would be required to make limited financial disclosures, which could give the public a clearer picture of his holdings. And, unlike Mr. Trump, who as president will be exempt from conflict-of-interest laws, he would have to recuse himself from decisions with a “direct and predictable effect” on his financial interests.

Jamie S. Gorelick, a WilmerHale partner who served in the Clinton administration, said that while plans were not final, Mr. Kushner was taking significant steps to extricate himself from the family business. “Mr. Kushner is committed to complying with federal ethics laws, and we have been consulting with the Office of Government Ethics regarding the steps he would take,” she said.

He will resign as chief executive of Kushner Companies, and though the law does not require it, she said he would divest “substantial assets.” She did not name them, but Ms. Heller said they would include his stake in 666 Fifth Avenue.

Just how meaningful that plan is remains to be seen. Mr. Kushner’s representatives declined to detail his personal financial interest in Kushner Companies’ properties, and they said he intended to keep his interest in other properties beyond 666 Fifth Avenue. He also has a stake, through a family investment vehicle, in a private equity firm run by his brother, Joshua, with far-flung investments of its own.

Mr. Kushner, who turns 36 on Tuesday, has emerged as one of the most powerful figures in Mr. Trump’s orbit. Already he is involved in steering policy, making personnel choices and serving as the middleman between foreign leaders, the White House and the president-elect in ways that could affect his business, even as companies like Anbang see opportunity in entering into new ventures with the president-elect’s son-in-law.

Mr. Kushner played a pivotal role in persuading Mr. Trump, who made the Wall Street powerhouse Goldman Sachs a bête noire of his presidential campaign, to appoint the firm’s president, Gary D. Cohn, as his chief economic adviser, according to several people involved in the transition. (Like a number of people interviewed for this article, they spoke on the condition of anonymity because they were not authorized to discuss internal matters.) Goldman Sachs has lent the Kushner Companies money and is an investor in a real estate technology company co-founded by Mr. Kushner and his brother.

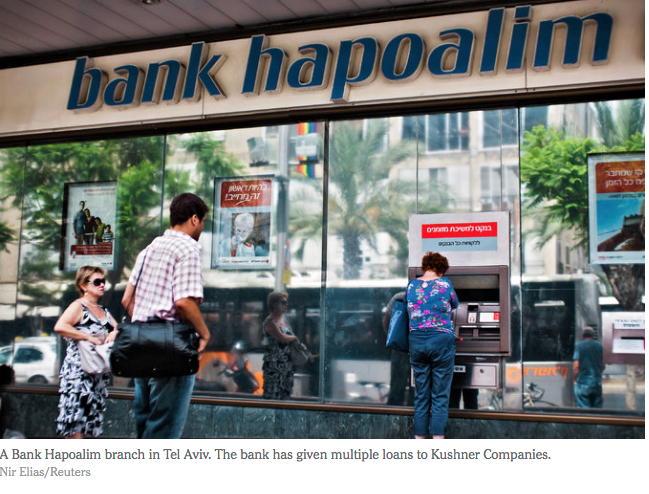

Mr. Trump has said that his son-in-law, an Orthodox Jew, will play a central role in dealings with Israel, describing him as so talented that he could help “do peace in the Middle East.” Mr. Kushner’s company has received multiple loans from Israel’s largest bank, Bank Hapoalim. The incoming Trump administration will inherit a Justice Department investigation into allegations that the bank helped wealthy Americans evade taxes.

Indeed, despite a lack of foreign policy experience, Mr. Kushner is emerging as an important figure at a crucial moment for some of America’s most complicated diplomatic relationships. Such is his influence in the geopolitical realm that transition officials have told the Obama White House that foreign policy matters that need to be brought to Mr. Trump’s attention should be relayed through his son-in-law, according to a person close to the transition and a government official with direct knowledge of the arrangement.

So when the Chinese ambassador to the United States called the White House in early December to express what one official called China’s “deep displeasure” at Mr. Trump’s break with longstanding diplomatic tradition by speaking by phone with the president of Taiwan, the White House did not call the president-elect’s national security team. Instead, it relayed that information through Mr. Kushner, whose company was not only in the midst of discussions with Anbang but also has Chinese investors.

Ethics experts said that while the conflict-of-interest law is narrowly drawn, Mr. Kushner’s mix of roles leads inevitably to ethical questions.

Matthew T. Sanderson, a lawyer at Caplin & Drysdale and former general counsel to Senator Rand Paul’s presidential campaign, said deals like the one with Anbang “might not be illegal under the conflict-of-interest rules, but raise a strong appearance that a foreign entity is using Mr. Kushner’s business to try to influence U.S. policy.”

Without knowing details of Mr. Kushner’s holdings and divestiture plans, he said, the merits of his proposal are hard to assess. Even if he divests his stake in certain properties, Mr. Sanderson added, “it strikes me as a half-measure” that “still poses a real conflict-of-interest issue and would be a drag on Mr. Trump’s presidency and cause the American people to question Mr. Kushner’s role in policy making.”

Without knowing details of Mr. Kushner’s holdings and divestiture plans, he said, the merits of his proposal are hard to assess. Even if he divests his stake in certain properties, Mr. Sanderson added, “it strikes me as a half-measure” that “still poses a real conflict-of-interest issue and would be a drag on Mr. Trump’s presidency and cause the American people to question Mr. Kushner’s role in policy making.”

The Family Business

Like the president-elect, Mr. Kushner built on the fortune of a successful father.

In the 1980s, his father, Charles Kushner, took over the New Jersey-based construction business started by his own father, a Holocaust survivor from Poland. Charles expanded into office buildings and apartments, eventually assembling a $1 billion real estate business and becoming a leading Democratic donor, contributing to politicians in New Jersey and New York and winning appointment to the board of the Port Authority of New York and New Jersey.

But the company was upended when Charles became engulfed in a nasty family feud over how the business’s proceeds were to be distributed. The fight, which played out in a federal courthouse in Newark, resulted in a plea deal for Charles, who in 2005 was sentenced to two years in prison for tax evasion, witness tampering and making illegal campaign donations. The family infighting was so bitter that, at one point, Charles hired a prostitute to seduce his brother-in-law, videotaped the encounter and sent the footage to his sister.

Jared, 23 at the time of his father’s conviction, had recently graduated from Harvard. He was studying for an M.B.A. and law degree at New York University in 2006 when he bought The New York Observer, at the time an influential weekly newspaper known for its coverage of the city’s elite and high-end real estate.

It is unclear exactly when he assumed control of the family business. The company now says he became chief executive in 2008, but contemporaneous news accounts rarely describe him that way until 2012. Nevertheless, Mr. Kushner quickly became the company’s public face as it expanded across the Hudson River into Manhattan, much as Mr. Trump had left Queens for the big city decades before.

Charles Kushner was released from federal custody in August 2006. He immediately resumed a significant role in the business and remains heavily involved today. Still, it was with Jared as headliner that the company soon made its biggest play ever: $1.8 billion for the skyscraper at 666 Fifth Avenue that would remain at the center of its story to this day. It was the highest price ever paid for a single office building in the United States — and more than three times what its seller had paid six years earlier.

Around this time, Mr. Kushner met the woman he would marry: Ivanka Trump. “J-Vanka,” the headlines blared, as the New York tabloids celebrated a match made in real estate heaven.

Everything was looking up, until suddenly it wasn’t. Within a year after the deal, the overheated lending market seized up and Kushner Companies struggled to repay its considerable loans — and to hold on to 666 Fifth Avenue. To the rescue over the next few years came the Carlyle Group, a giant private equity firm; Vornado Realty Trust, then a co-owner of two of Mr. Trump’s largest properties; and Inditex, owner of Zara, the fashion retailer founded by Amancio Ortega, the Spanish tycoon who is one of the world’s wealthiest men.

In the end, Mr. Kushner’s company survived, and he and Ms. Trump became fixtures on the international boldface-name circuit.

In August, they were spotted with Wendi Deng, an ex-wife of Rupert Murdoch, on the 453-foot yacht Rising Sun, owned by the entertainment mogul David Geffen. Several weeks later, they were photographed watching the United States Open tennis finals with the art collector Dasha Zhukova, wife of the Russian oligarch Roman Abramovich, a member of President Vladimir V. Putin’s inner circle.

Since 2012, Kushner Companies has been on a buying spree. It has acquired at least 120 properties, mostly a mix of existing commercial and residential buildings in New York and New Jersey, according to data compiled by Real Capital Analytics, a research firm.

Recent deals include the $340 million acquisition of the Jehovah’s Witnesses’ headquarters in the shadow of the Brooklyn Bridge, and $345 million for a nearby plot of undeveloped land. Mr. Kushner’s company also bought several floors of the old New York Times building for $295 million in 2015 from Lev Leviev, an Israeli who is chairman of one of the largest real estate development companies in Russia.

Increasingly, the company is branching out across the country — to Philadelphia; Baltimore; Toledo, Ohio; and Kansas City, Mo. In Chicago, it owns the building that houses the Midwest headquarters of AT&T. In all, the company owns more than 20,000 apartments and approximately 14 million square feet of office space.

Investors and Creditors

As the Kushners have expanded their businesses, they have also, by necessity, expanded their universe of investors and creditors. Lenders have included private equity giants like Blackstone, the French bank Natixis and Goldman Sachs. Another lender is Deutsche Bank, which recently reached a $7.2 billion settlement with the Justice Department over its sale of toxic mortgage securities. But it remains under investigation over allegations that it disguised trades that helped Russian clients move money offshore.

Beyond real estate, Mr. Kushner has moved into the Wall Street, health care and tech spaces.

He has an indirect investment in Thrive Capital, a venture capital firm valued at about $1.5 billion that is run by his brother, Joshua. The company has made more than 100 investments in dozens of companies, both in the United States and abroad. Among them is Oscar, a health insurance company founded in 2012 to take advantage of the Affordable Care Act, which Mr. Trump has vowed to dismantle. Oscar’s investors have included Li Ka-shing, who is one of Hong Kong’s richest men, and China’s Ping An Insurance, which has close ties to relatives of former Prime Minister Wen Jiabao of China.

The Kushner brothers have counted the Russian billionaire tech investor Yuri Milner and the Chinese billionaire founder of Alibaba, Jack Ma, as investors in another endeavor — Cadre, a tech-savvy real estate investment company they started with a friend. Goldman Sachs has invested in both tech ventures.

But the money behind many of Mr. Kushner’s real-estate investments remains a mystery. While the company lists dozens of partners on its website, it does not disclose the individuals behind those companies.

One of the newest Kushner projects — a Trump-branded luxury apartment tower that opened in November in Jersey City — got nearly a quarter of its financing, about $50 million, from Chinese investors who are not publicly identified.

The investors are beneficiaries of a federal program that grants two-year visas and a path to permanent residency in exchange for investments of $500,000. The program, known as EB-5, has become popular with real estate developers as a cheap form of financing; in fiscal year 2015, the State Department issued 9,764 of the visas — overwhelmingly to applicants from China.

But the program, which must be renewed periodically by Congress, has lately come under fire. The Government Accountability Office has issued several reports raising concerns about what it termed the program’s insufficient background checks and lax safeguards against illicit financing. One applicant, the agency found, failed to report potential financial ties to a string of Chinese brothels.

Then there are the Kushners’ continuing negotiations with Anbang’s Mr. Wu, one of the most politically connected men in China.

Anbang Draws Scrutiny

In 2015, Mr. Kushner began pursuing a grand vision for 666 Fifth Avenue. The renowned architect Zaha Hadid was asked to come up with a design to resculpt the 40-story, 1950s-era aluminum-clad office building, adding apartments, a hotel and a mall and nearly tripling its height to 1,400 feet.

But the plan needed money, and while Mr. Kushner had managed to hang on to his family’s flagship building, it still had a lot of debt, with a $1.1 billion loan coming due in 2019, and a good portion of the commercial office space vacant.

Anbang, which got its start as an auto insurance company in 2004, had become one of the most aggressive Chinese buyers of United States real estate, and had begun investing in hotels. But it had encountered problems of its own; its byzantine ownership structure had given rise to concern on Wall Street and in Washington.

The Times reported last year that Anbang is owned by a few dozen companies, which in turn are owned by a number of shell companies that are controlled by roughly 100 people, many of whom have ties to a county in China that is the home of Mr. Wu, whose own power stems in part from marriage. In his case he married Zhuo Ran, a granddaughter of Deng Xiaoping, the leader who brought China out of the chaos of the Mao era. Mr. Wu also counts as a central business partner the son of a People’s Liberation Army marshal, and he has recruited several former government insurance regulators to serve on his board.

Anbang’s structure has stoked such suspicion about its true ownership that some Wall Street firms, including Morgan Stanley, have opted not to advise the company on United States mergers and acquisitions because they cannot get the information needed to satisfy their “know your client” guidelines.

Anbang’s deep ties to the Chinese state have also led to a break in presidential protocol. Presidents have long stayed at the Waldorf, but when Mr. Obama visited New York for the opening of a session of the United Nations General Assembly in September 2015, he decided to seek other accommodations. American officials were vague about the reasons for the change at the time; a senior national security official cited security, counterintelligence and cybersurveillance concerns.

National security concerns have also complicated Anbang’s efforts to acquire other properties in the United States.

One deal, to buy the Hotel del Coronado in San Diego, fell apart in October amid concerns from the Committee on Foreign Investment in the United States, which comprises the heads of nine federal agencies and is charged with reviewing the national security risks of transactions involving foreign governments or state-connected companies. The Hotel del Coronado is near a naval base, and deals involving proximity to national security infrastructure typically receive heightened scrutiny. Anbang was, however, able to acquire the other hotels in the same collection.

Last year, Anbang tried to purchase the Starwood Hotels chain, outbidding Marriott with a $14 billion offer. It was widely reported that the deal would be subject to review by the committee. But though the parties expressed confidence that it would pass muster, ultimately Anbang walked away from the deal before submitting the kind of detailed inside information that process would entail.

And while Anbang’s planned $1.57 billion purchase of Des Moines-based Fidelity & Guaranty Life, first announced in November 2015, was cleared by the committee, also known as Cfius, it stalled after the New York State Department of Financial Services demanded more information about Anbang’s shareholding structure.

But Anbang was nothing if not savvy. Company officials had cultivated a relationship with Benjamin M. Lawsky, who had earlier led the financial services agency, from May 2011 to June 2015. It was Mr. Lawsky, by then a consultant, who introduced Anbang to Kushner Companies, according to people with knowledge of how the discussions came about. Mr. Lawsky declined to comment.

Mr. Kushner led the negotiations, his spokeswoman, Ms. Heller, confirmed. Kushner Companies would disclose little else about the joint venture, except to say that Anbang would become one of the equity partners in the building’s redevelopment if an agreement is finalized. Anbang declined to comment.

It was just coincidence that Mr. Kushner’s Nov. 16 dinner at the Waldorf with Mr. Wu took place the week after the election, Ms. Heller said, adding that it had been in the works for a while.

By the time of the meeting, Mr. Kushner had decided to hand off certain business relationships, including the one with Anbang, to others at Kushner Companies, according to Ms. Heller, and it was for that reason that he invited his father and Laurent Morali, the president of Kushner Companies. She said he planned to sell his stake in 666 Fifth before the closing of any Anbang deal, but she declined to name the potential buyers or the price Mr. Kushner hoped to get.

Ms. Heller stressed in her statement that the United States has “not found Anbang to be a state-owned enterprise” — an important technical point, given that the Constitution’s Emoluments Clause prohibits the acceptance of payments and gifts from foreign governments.

Should it consummate its deal with Anbang, she said, Kushner Companies will seek any necessary approvals from the federal government. She expressed confidence that any deal would pass muster with the foreign investment committee, citing the fact that it did not block the Chinese company from buying the Waldorf Astoria.

Come Jan. 20, when Mr. Trump is scheduled to be inaugurated, that committee will be made up of his cabinet members, and the process is such that the president has the final say.

It is a process with which Mr. Trump has some familiarity. During the campaign, he repeatedly criticized Hillary Clinton for supporting, as secretary of state and member of the foreign investment committee, a deal that benefited donors to her family’s charitable foundation while giving the Russians control of about 20 percent of America’s uranium-extraction capacity.

On China, Mr. Trump has talked a tough game, accusing Beijing of currency manipulation and raising the possibility of a trade war. But whether that is only a negotiating tactic remains to be seen. The president-elect has his own financial entanglements with China: He owns a 30 percent stake in a partnership that owes roughly $950 million to a group of lenders that includes the Bank of China, and one of his biggest tenants at Trump Tower is another state-owned bank, the Industrial and Commercial Bank of China.

With Anbang a magnet for controversy, Mr. Kushner has kept the negotiations under wraps. But a week after the Nov. 16 dinner at the Waldorf, Mr. Kushner’s father and Mr. Wu met at the hotel for lunch. After the elder Mr. Kushner departed, Mr. Wu was clearly elated.

“I love you guys,” he exclaimed in English to his remaining entourage, according to one person present.

You must be logged in to post a comment Login