A New Jersey congressman says a rarely invoked 1924 law could be used to examine President Donald Trump’s tax returns for possible conflicts of interest and Constitutional violations.

CLICK IMAGES FOR LINK TO STORY

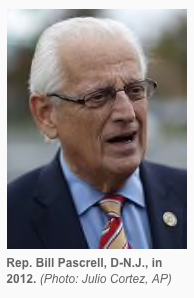

Rep. Bill Pascrell, a Democrat who serves on the Ways and Means Committee, has asked the committee’s chairman, Rep. Kevin Brady of Texas, to order the Treasury Department to provide tax returns to the committee. Brady’s office did not respond to a request for comment Friday.

After privately examining returns — Pascrell is seeking 10 years’ worth — the committee could decide to share them with the full House, which would in effect make them public. The 1924 law gives congressional committees that set tax policy the power to examine tax returns. It was used in 1974 when Congress looked at President Richard Nixon’s returns, and in 2014 when the Ways and Means Committee released confidential tax information as part of its investigation into the Internal Revenue Service’s handling of applications for nonprofit status.

Trump said during the campaign he would not release his returns because he was being audited. After the inauguration, adviser Kellyanne Conway said he would not release them because the public did not care.

Pascrell said what happened in the election does not matter.

“This isn’t for the Democrats or the Republicans, and it’s not to embarrass anybody,” he said. “This is to make sure the American people know the facts, and if there are conflicts, they need to be resolved.”

Asked if he thought he would succeed, Pascrell said he believes many Republicans in the House and Senate “are absolutely intimidated by this president.”

But on a different issue, the top Republican and Democrat on a key committee asked a top ethics regulator on Thursday to investigate whether Conway, a senior aide to Trump, violated ethics rules when she said in a television interview that people should buy the president’s daughter’s clothing line.

Pascrell said he did not believe Trump has turned over control of his companies to his children, and even if he did, Pascrell agreed with ethics officials who oversee the executive branch that that is not sufficient to avoid conflicts.

Pascrell also said he believes Trump is violating the “emoluments clause” of the Constitution, which bars federal officials from receiving gifts or other things of value from foreign governments. He raised that issue in a Feb. 1 letter to Brady.

We know that state-owned enterprises in China and the United Arab Emirates are involved in his businesses, and that his business ties stretch to India, Turkey and the Philippines and beyond,” Pascrell wrote. “Russia, Saudi Arabia and Taiwan may also have ties to his businesses.”

Pascrell said foreign governments are paying rents, licensing fees, and issuing permits for Trump Organization projects, all of which could be used to influence the president.The letter asked Brady to reply by Wednesday.

“If I get a ‘no’ answer on this, I’ll be very honest with you: If these guys think I’m walking away from this, they’re absolutely nuts,” Pascrell said. “The calls we’re getting, the calls other congressmen are getting, it’s unbelievable, we never expected this.”

Members of Congress are not required to release their tax returns, but must file financial disclosure forms, similar to one Trump had to file when he ran for president, outlining sources of income and the value of certain assets.

Pascrell, who is in his 11th term in the House, does not regularly release his own tax returns. In January 2012, when he was running in a competitive Democratic primary, he released his 2010 return after learning his opponent had also done so.

It showed Pascrell, now 80, had $267,518 in income in 2010, including his congressional salary and New Jersey pension from service as a state legislator, mayor and Paterson employee. He and his wife paid $57,740 in federal taxes, or an effective tax rate of 22 percent.

You must be logged in to post a comment Login