For Donald J. Trump, it is a long-held legal strategy, if not a point of pride, to avoid knuckling under to plaintiffs in court.

“I don’t settle lawsuits — very rare — because once you settle lawsuits, everybody sues you,” he said recently.

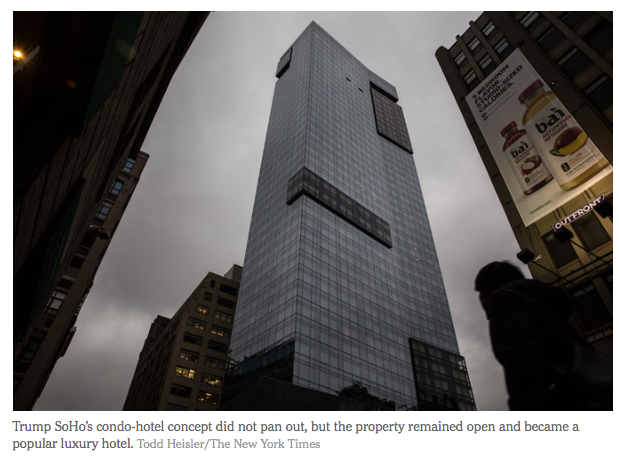

But Mr. Trump made an exception when buyers of units in Trump SoHo, a 46-story luxury condominium-hotel in Lower Manhattan, asserted that they had been defrauded by inflated claims made by Mr. Trump, his children and others of brisk sales in the struggling project. He and his co-defendants settled the case in November 2011, agreeing to refund 90 percent of $3.16 million in deposits, while admitting no wrongdoing.

The backdrop to that unusual denouement was a gathering legal storm that threatened to cast a harsh light on how he did business. Besides the fraud accusations, a separate lawsuit claimed that Trump SoHo was developed with the undisclosed involvement of convicted felons and financing from questionable sources in Russia and Kazakhstan.

And hovering over it all was a criminal investigation, previously unreported, by the Manhattan district attorney into whether the fraud alleged by the condo buyers broke any laws, according to documents and interviews with five people familiar with it. The buyers initially helped in the investigation, but as part of their lawsuit settlement, they had to notify prosecutors that they no longer wished to do so.

The criminal case was eventually closed.

Mr. Trump’s campaign for the Republican presidential nomination rests on the notion, relentlessly promoted by the candidate himself, that his record of business deals has prepared him better than his rivals for running the country. An examination of Trump SoHo provides a window into his handling of one such deal and finds that decisions on important matters like whom to become partners with and how to market the project led him into a thicket of litigation and controversy.

Trump SoHo is one of several instances in which Mr. Trump’s boastfulness — a hallmark of his career and his campaign — has been accused of crossing the line into fraud. Other lawsuits have charged that he peddled worthless real estate sales courses and misled investors into thinking he had built hotels when in fact he had only licensed his name to them. He has won several cases at trial and is continuing to fight others.

Alan Garten, the general counsel for the Trump Organization, said that the condo buyers’ lawsuit was not focused on Mr. Trump himself “in any material way” and that there was little reason not to settle it, adding that it cost Mr. Trump nothing. “It was solely a function of returning deposits,” Mr. Garten said.

He described the case as “buyer’s remorse,” in which people who bought real estate at the wrong time turned to the courts to recoup their investment.

Mr. Garten would not talk about the criminal investigation or whether it was a factor in the decision to settle.

“The terms of the settlement are confidential, and thus I’m not at liberty to discuss them,” he said.

The district attorney’s office declined to comment, saying it could not provide information on “a criminal investigation which does not result in an arrest or prosecution.”

When Mr. Trump and his co-defendants made the decision to settle the condo buyers’ lawsuit in 2011, it was a far cry from the heady days of 2006, when Mr. Trump closed an episode of his hit television show “The Apprentice” with a splashy plug for Trump SoHo. In typical Trump fashion, he piled on the plaudits for “my latest development.”

“When it’s completed in 2008,” he said, “this brilliant $370 million work of art will be an awe-inspiring masterpiece.”

Jumping In With New Partners

To the artists and creative types inhabiting its trendy downtown Manhattan neighborhood, Trump SoHo was an oxymoron from the start. Many of them loudly opposed a huge glass tower at 246 Spring Street that would stab the sky high above its low-key surroundings.

If the plans for it attracted controversy, so too would the company most responsible for its development: Bayrock Group.

Mr. Trump was foggy on how he first came to do business with Bayrock, a small development company whose offices were in Trump Tower in Midtown. In a deposition a few years ago, he said it might have been a Bayrock associate, Felix H. Sater, who first approached him in the early 2000s.

Mr. Sater, a Russian immigrant, had recently joined Bayrock at the behest of its founder, Tevfik Arif, a former Soviet-era commerce official originally from Kazakhstan. Bayrock, which was developing commercial properties in Brooklyn, proposed that Mr. Trump license his name to hotel projects in Florida, Arizona and New York, including Trump SoHo.

The other development partner for Trump SoHo was the Sapir Organization, whose founder, Tamir Sapir, was from the former Soviet republic of Georgia. In addition to receiving a licensing agreement, Mr. Trump would manage the completed condo-hotel, and he was also given a minor equity interest in it.

Emails and testimony in several lawsuits show that Mr. Sater and Mr. Arif worked closely with Mr. Trump and others in the Trump Organization. Mr. Trump was particularly taken with Mr. Arif’s overseas connections. In a deposition, Mr. Trump said that the two had discussed “numerous deals all over the world” and that Mr. Arif had brought potential Russian investors to Mr. Trump’s office to meet him.

“Bayrock knew the people, knew the investors, and in some cases I believe they were friends of Mr. Arif,” Mr. Trump said. “And this was going to be Trump International Hotel and Tower Moscow, Kiev, Istanbul, etc., Poland, Warsaw.”

What sort of due diligence Mr. Trump did before jumping in with his new partners is unclear. But he, as well as many others, apparently missed some dark spots on Mr. Sater’s résumé. Mr. Garten said the Trump Organization typically did a background check on potential business partners like Bayrock, but not on their individual employees, so nothing about Mr. Sater would have turned up.

Mr. Sater was convicted and sent to prison in 1993 after a New York bar fight in which he stabbed a man in the face with a broken margarita glass. That was a matter of public record. However, what few people beyond insiders at Bayrock knew was that five years later, Mr. Sater was implicated in a huge stock manipulation scheme involving Mafia figures and Russian criminals — and that he became a confidential F.B.I. informant.

Recently unsealed federal court records show that Mr. Sater helped the government disrupt an organized crime ring on Wall Street and deal with an unexplained national security matter involving his foreign connections. He was not the only F.B.I. informant in Bayrock’s offices. Another was Salvatore Lauria, an associate of Mr. Sater, who sometimes showed up to work wearing a court-ordered ankle monitor.

Mr. Lauria brokered a $50 million investment in Trump SoHo and three other Bayrock projects by an Icelandic firm preferred by wealthy Russians “in favor with” President Vladimir V. Putin, according to a lawsuit against Bayrock by one of its former executives. The Icelandic company, FL Group, was identified in a Bayrock investor presentation as a “strategic partner,” along with Alexander Mashkevich, a billionaire once charged in a corruption case involving fees paid by a Belgian company seeking business in Kazakhstan; that case was settled with no admission of guilt.

Slowing Sales and a Lawsuit

The official unveiling of Trump SoHo in September 2007 was quintessential Trump: a red-carpet announcement followed by a big bash, where flavored vodka flowed, dancers whirled and models wandered about. Amid the hoopla, Mr. Trump took the microphone to extol the greatness of the project. Standing beside him, beaming, were Mr. Arif and Mr. Sater.

The timing of Trump SoHo’s completion and marketing could hardly have been worse. The real estate bubble was bursting, and the global economy was on the brink of crisis as the developers began advertising luxury condo-hotel units costing as much as tens of millions of dollars.

The economics of the investment were largely untested in New York real estate. To get around residential zoning restrictions, owners of Trump SoHo units were allowed to live in them only 120 days a year. The rest of the time, the units would be rented as hotel rooms, with the owners sharing in the revenue.

The project was marketed aggressively to potential investors overseas, where exchange rates were favorable and the Trump brand carried a certain cachet. Many early buyers were from Europe, including a French former soccer star, Olivier Dacourt, who put down a deposit of $460,400 on a $2.3 million unit.

After an initial flurry of activity, the pace of sales slowed considerably. In addition to the economic decline, Trump SoHo was jolted by bad publicity when The New York Times published an article in December 2007 revealing Mr. Sater’s criminal past.

According to data the Trump SoHo developers filed with state and federal agencies, only 15 to 30 percent of the units had been sold by the start of 2009. But those numbers did not come close to the grand-sounding sales figures promoted, publicly and in private, by people affiliated with Trump SoHo, according to a lawsuit filed in August 2010 by Mr. Dacourt and other people who had bought units.

In June 2008, Mr. Trump’s daughter Ivanka was quoted in a Reuters article saying that about 60 percent of the units had been sold. In April 2009, Mr. Trump’s son Donald Jr. appeared in another news article saying that 55 percent of the units were sold by March of that year. More purported cases of puffery occurred in emails and statements by sales agents.

The lawsuit also suggested that Mr. Trump had contributed to the deception, citing a claim he made at the project’s unveiling. Depending on the news account, he said 3,200 prospective purchasers either had signed up to see the units or had requested applications to buy them; the plaintiffs argued that this figure was exaggerated, given how few units had actually been sold at the time. The Trumps and the other defendants denied that there had been any deception.

The inflated numbers were more than just harmless self-promotion and amounted to fraudulent enticement of investors, who believed they were buying into a project that was healthier than it actually was, said Adam Leitman Bailey, the lawyer representing the buyers.

“They relied on these misrepresentations to their detriment,” he said.

The people familiar with the criminal investigation said that not long after Mr. Bailey’s lawsuit was filed, the district attorney’s office began looking into the allegations it had raised. These people insisted on anonymity for fear of legal repercussions from speaking about confidential agreements or sealed criminal matters.

Documents reviewed by The Times, including a state grand jury subpoena, make clear that an area of focus for prosecutors was determining whether the accusations in Mr. Bailey’s lawsuit rose to the level of a crime. The investigation was being handled by the Major Economic Crimes Bureau.

Gradually Cutting Ties

Shortly before the condo buyers’ lawsuit was filed, another suit appeared, this one by Jody Kriss, a former finance director of Bayrock. It claimed that by concealing Mr. Sater’s criminal record, Bayrock had committed fraud on banks and investors with which it did business. Mr. Trump is not a defendant in that case, which is continuing.

Mr. Kriss’s lawsuit was filled with unflattering details of how Bayrock operated, including allegations that it had occasionally received unexplained infusions of cash from accounts in Kazakhstan and Russia. Bayrock and Trump SoHo drew more negative headlines in October 2010, when news spread from Turkey that Mr. Arif had been aboard a luxury yacht raided by the police, who were investigating a suspected prostitution ring that catered to wealthy businessmen. He was charged but later acquitted.

The next year, when it was clear that Mr. Bailey’s lawsuit would be allowed to proceed and with the district attorney’s criminal investigation continuing, Mr. Trump and his co-defendants agreed to settle the condo buyers’ suit. The financial terms were announced publicly, but another part of the settlement was kept secret.

That part required the plaintiffs to notify any investigative agency with which they “may have previously cooperated” that they did not want to “participate in any investigation or criminal prosecution” related to matters in the lawsuit, according to a confidentiality agreement signed by more than 20 people. The plaintiffs could respond to a subpoena or court order, but would also have to notify the defendants that they had received it, the agreement said. The criminal investigation was closed sometime afterward.

As for Trump SoHo, the condo-hotel concept did not pan out. Only about a third of the units were ultimately sold, and one of the project’s lenders foreclosed on the rest, although the property remained open and became a popular luxury hotel, still managed by Mr. Trump’s company.

Mr. Sater left Bayrock after the news of his criminal background was reported. But even after that, his association with Mr. Trump did not end. The Trump Organization later gave him a business card identifying him as a “senior advisor” to Mr. Trump, as well an office. Mr. Garten, the general counsel for the organization, said that Mr. Sater was never an employee, but that he had worked independently to steer potential deals to Mr. Trump. The arrangement lasted about six months, Mr. Garten said. Mr. Sater declined to comment on his dealings with Mr. Trump or with Bayrock.

By the time Mr. Trump sat for a deposition in a lawsuit in November 2013, it was clear he no longer saw the benefit of knowing the Bayrock executives with whom he had once completed big deals. He said he barely knew Mr. Arif: “I mean, I’ve seen him a couple of times; I have met him.”

As for Mr. Sater, “if he were sitting in the room right now,” Mr. Trump said, “I really wouldn’t know what he looked like.”

You must be logged in to post a comment Login